Consumer Credit in Australia: What It Means for Your Financial Plan

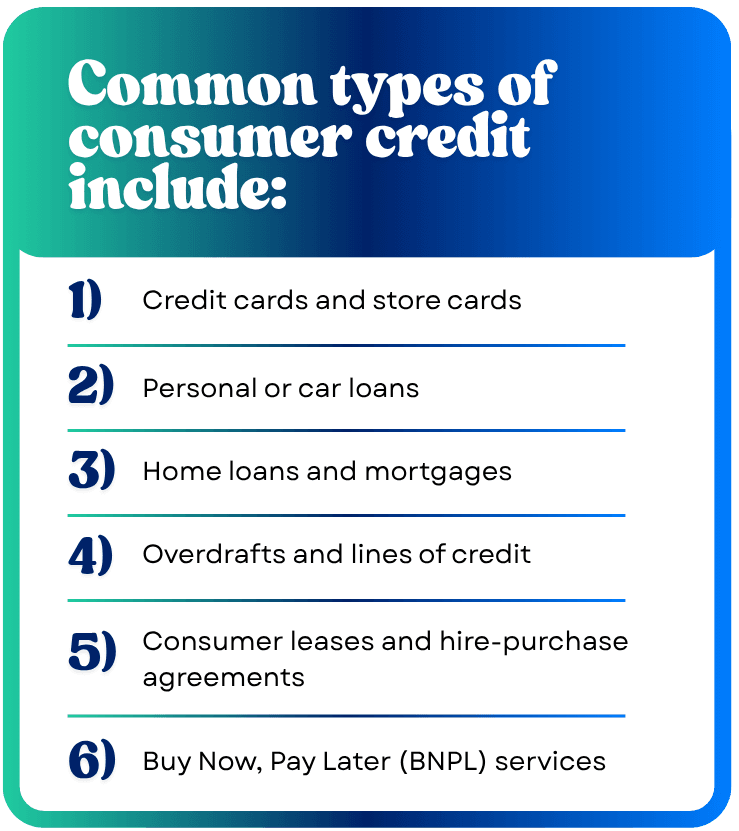

Consumer credit touches almost every aspect of modern Australian life — from credit cards and personal loans to car financing and “buy now, pay later” (BNPL) platforms. Used wisely, it can offer flexibility and opportunity. Managed poorly, it can trap individuals in cycles of debt that undermine long-term financial security.

Consumer credit touches almost every aspect of modern Australian life — from credit cards and personal loans to car financing and “buy now, pay later” (BNPL) platforms. Used wisely, it can offer flexibility and opportunity. Managed poorly, it can trap individuals in cycles of debt that undermine long-term financial security.

For Australians striving to build wealth, credit management isn’t just about repaying loans — it’s about integrating borrowing decisions into a well-structured financial plan. This ensures that every dollar borrowed serves a clear purpose aligned with your goals, cash flow, and risk capacity.

This blog will cover:

- What is Consumer Credit?

- The Legal Framework

- Consumer Rights and Protection

- Consumer Credit and Financial Planning: How They Interconnect

- Common Credit Pitfalls Australians Should Avoid

- How a Financial Advisor Can Help You Manage Consumer Credit

- Case Study Example

- Practical Tips for Smarter Credit Use

- The Future of Consumer Credit in Australia

- Conclusion

What Is Consumer Credit?

Consumer credit refers to any arrangement where a lender provides funds or goods to an individual for personal, household, or domestic use, to be repaid over time, typically with interest or fees.

The Legal Framework

Australia’s consumer credit system is governed primarily by the National Consumer Credit Protection Act 2009 (Cth) (NCCP Act) and the National Credit Code. Together, these establish a national framework that regulates lenders and protects borrowers.

Under this framework:

- Lenders and brokers must hold an Australian Credit Licence (ACL).

- Credit providers must comply with responsible lending obligations, ensuring loans are suitable and affordable.

- Consumers are entitled to clear disclosure of fees, interest rates, and repayment terms.

- Borrowers have rights to hardship variations, default notices, and dispute resolution through the Australian Financial Complaints Authority (AFCA).

These laws are enforced by the Australian Securities and Investments Commission (ASIC), which monitors compliance and takes action against misconduct.

Consumer Rights and Protections

Borrowers in Australia enjoy strong legal protections, including:

- Responsible Lending – Lenders must verify your income, expenses, and capacity to repay without hardship.

- Disclosure Obligations – You must receive a written contract detailing rates, fees, and total repayment costs.

- Hardship Assistance – If you face financial stress due to job loss, illness, or emergencies, you can apply for a hardship variation to adjust repayment terms.

- Default Notices – Lenders must issue a formal notice (usually 30 days) before repossessing secured goods or pursuing court action

- Dispute Resolution – You can escalate unresolved issues to AFCA, a free and independent complaints body.

- Protection from Unfair Conduct – The law prohibits misleading, unconscionable, or predatory lending practices.

These safeguards ensure that consumers are not exploited or trapped in unfair contracts — but they work best when borrowers understand and assert their rights.

Here’s how consumer credit fits into financial planning.

1. Cash Flow and Budget Management

Every credit product introduces recurring repayments. A planner helps map these out within your monthly cash flow, ensuring you can comfortably meet obligations while still saving and investing.

They also model “what-if” scenarios — such as interest rate hikes or income reduction — to stress-test your ability to stay afloat.

2. Debt Prioritisation and Repayment Strategy

A key part of financial planning is identifying which debts to pay off first. Generally:

- High-interest unsecured debts (like credit cards) are top priority.

- Low-interest or deductible debts (such as investment loans) may be lower priority.

- Mortgage or secured loans may be managed strategically for tax or liquidity benefits.

Financial planners often use “debt avalanche” (tackle highest interest first) or “debt snowball” (start with smallest balance for motivation) methods depending on your psychology and goals.

3. Leverage and Wealth Creation

Strategic borrowing can help fund wealth-building assets like property or investments. Financial planners assess whether leveraging debt enhances returns or increases risk.

They weigh the cost of borrowing against expected returns, ensuring you only take on “productive” debt — the kind that works for you, not against you.

4. Risk Management and Contingencies

A responsible financial plan includes protection measures such as:

- Emergency funds to handle unexpected costs without borrowing further

- Income protection or life insurance to cover loan repayments in case of illness or death

- Appropriate loan structures (e.g., fixed vs. variable) based on your risk profile

5. Behavioural Safeguards

Credit can tempt overspending. Financial planners incorporate behavioural strategies — such as reducing credit limits, automating repayments, or setting saving milestones — to prevent emotional or impulsive borrowing.

Common Credit Pitfalls Australians Should Avoid

While Australia’s consumer credit market is robust, many fall into the same traps. Here are the biggest:

- Relying on high-interest credit cards for everyday spending

- Ignoring BNPL service fees and fine print

- Borrowing to repay existing debt (debt spiral)

- Over-borrowing on car or personal loans

- Failing to request hardship relief when needed

- Not checking credit reports for errors or defaults

Each of these can derail a financial plan — but with professional guidance, they can be anticipated and managed.

How a Financial Advisor Can Help You Manage Consumer Credit

Financial advisors play a crucial role in helping Australians navigate the complex world of consumer credit. Whether you’re trying to pay off debt, improve cash flow, or plan a major purchase, their expertise ensures your credit strategy supports — not sabotages — your goals.

1. Comprehensive Debt Assessment

A financial advisor begins by analysing your full financial picture:

- Current debts (balances, rates, repayment terms)

- Income and expenses

- Credit score and borrowing capacity (debt spiral)

- Short- and long-term financial objectives

They identify high-cost debts, hidden fees, and inefficient credit structures that may be costing you money.

2. Crafting a Strategic Repayment Plan

Based on your cash flow and goals, an advisor develops a structured debt management plan that might include:

- Prioritising debts by cost or urgency

- Consolidating multiple debts into one manageable loan

- Refinancing to lower interest rates or shorter terms

- Setting realistic repayment milestones

3. Integrating Credit into Your Broader Financial Plan

An advisor ensures that your borrowing decisions align with your overall plan. For instance:

- If buying a home: they’ll determine the optimal loan-to-value ratio, repayment term, and offset strategy.

- If funding education or renovation: they’ll recommend whether to use savings, redraw equity, or seek a personal loan.

- If investing: they’ll assess whether leveraging debt aligns with your risk tolerance.

4. Guidance During Financial Hardship

If you experience job loss, illness, or reduced income, a financial advisor can:

- Help you apply for hardship variations under the National Credit Code

- Negotiate revised repayment terms with creditors

- Prioritise essential debts (like mortgage or utilities) over unsecured ones

- Refer you to accredited financial counsellors for legal or debt relief support

Their goal is to stabilise your finances before the situation escalates to default or collection.

5. Refinancing and Restructuring

Advisors constantly monitor market interest rates and product features. They may recommend refinancing to:

- Reduce interest costs

- Shorten repayment terms

- Switch from variable to fixed loans (or vice versa)

- Consolidate multiple loans into on

They ensure you understand refinancing costs, fees, and implications for your credit file.

6. Behavioural Coaching and Accountability

Sometimes, the hardest part of managing credit is not the math — it’s the mindset. Advisors act as behavioural coaches, helping you:

- Set healthy spending limits

- Avoid impulsive borrowing

- Stick to repayment commitments

- Celebrate progress toward being debt-free

Regular reviews and accountability meetings keep you disciplined and motivated.

7. Tax and Investment Efficiency

In some cases, advisors coordinate with accountants to make debt tax-efficient — for example, distinguishing between deductible investment loans and non-deductible personal debt.

They might also help you redirect savings from debt reduction into diversified investments once your liabilities are under control.

8. Protecting Your Credit Score and Future Borrowing Power

Advisors monitor how your credit behaviour affects your credit score — a key factor in securing better rates for future loans.

They help you correct errors, close unused accounts strategically, and plan borrowing moves that enhance (not damage) your financial reputation.

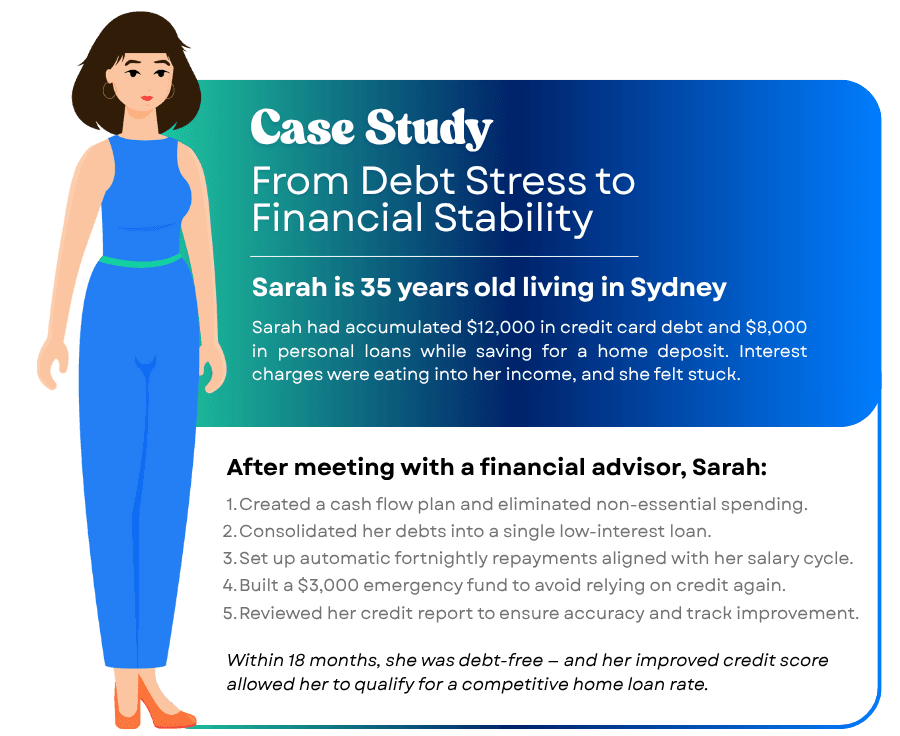

Case Study: From Debt Stress to Financial Stability

This case highlights how professional financial guidance can turn consumer credit from a burden into a manageable component of a successful financial plan.

Practical Tips for Smarter Credit Use

- Borrow only what you can afford to repay comfortably.

- Compare lenders — use ASIC’s MoneySmart calculators to assess total loan cost.

- Pay more than the minimum on credit cards or personal loans.

- Check your credit report annually (via Equifax or Experian).

- Avoid using credit for depreciating assets or lifestyle spending.

- Act early if you’re struggling — contact your lender or financial counsellor.

- Maintain an emergency savings buffer of 3–6 months’ expenses.

- Review your debt annually as part of your overall financial plan.

Conclusion

Consumer credit is neither inherently good nor bad — it’s a financial tool that requires skillful management. In Australia, strong legal frameworks protect borrowers, but personal discipline and informed decision-making remain the keys to success. Credit, when handled wisely, is not a barrier to wealth — it can be the bridge toward it.