Investing with CARE: Turning Emotional Decisions into Strategic Wealth

The CARE Investment Philosophy offers a structured approach to investing that focuses not only on where assets are placed, but also on how investors behave over time. Rooted in care, discipline, and long-term thinking, this philosophy transforms volatility from a source of fear into an opportunity for growth.

Investing isn’t just about numbers—it’s about human behavior. Markets rise and fall, but how investors react to those movements often determines their true success.

The CARE Investment Philosophy offers a structured approach to investing that focuses not only on where assets are placed, but also on how investors behave over time. Rooted in care, discipline, and long-term thinking, this philosophy transforms volatility from a source of fear into an opportunity for growth.

It begins by addressing a fundamental issue that has plagued investors for decades—the behavioral traps revealed by the famous Dalbar study.

This blog will cover:

- The Dalbar Effect: When Behavior Erodes Returns

- How Bad Behavior Happens: The Emotional Cycle of Investing

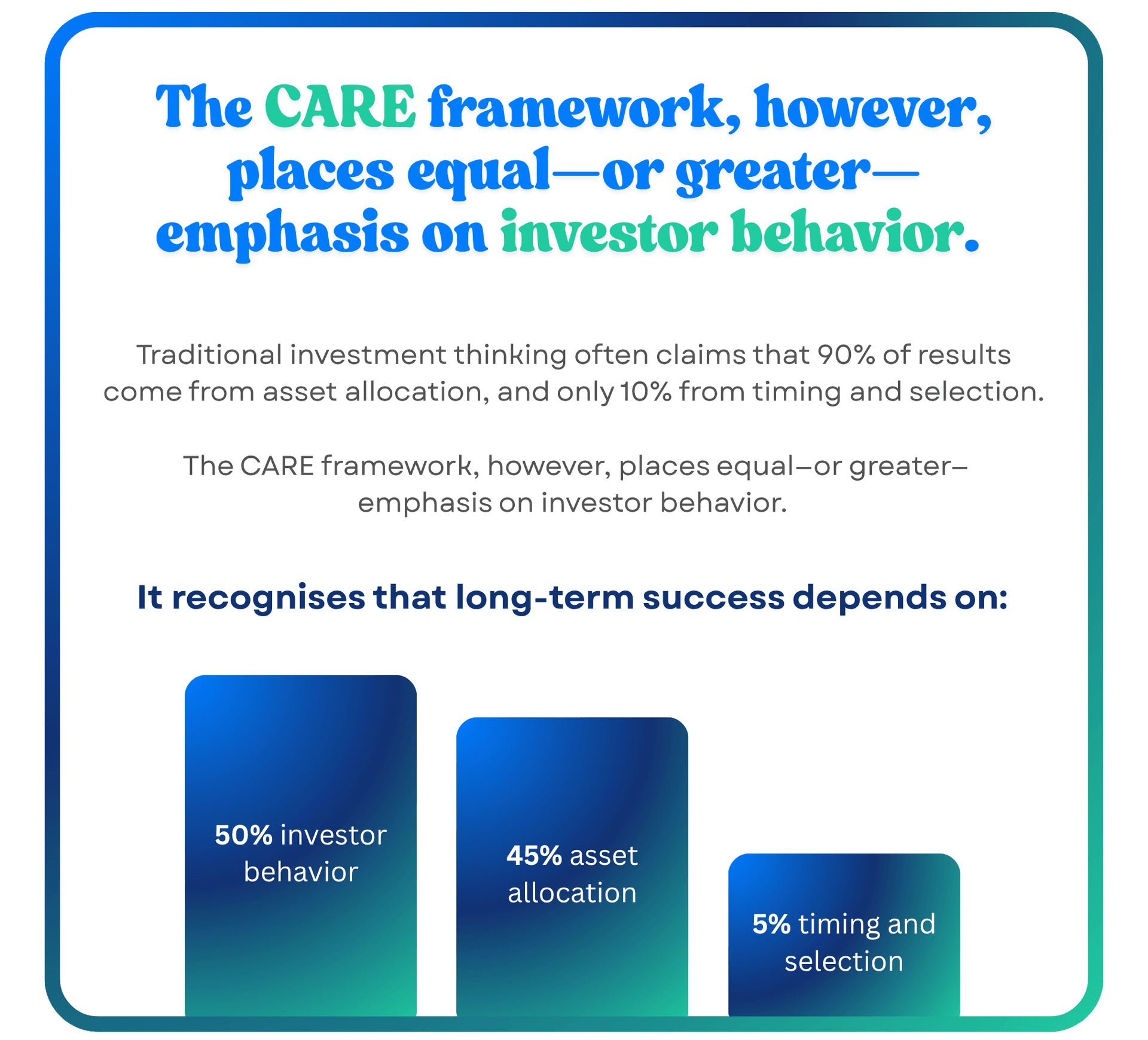

- The CARE Investment Equation: Why Behavior Matters Most

- Diversification: The “Blue Line” Approach

- The Four Pillars of the CARE Philosophy

- Beyond Investing: Coaching, Patience, and Perspective

- An Investment Philosophy for Real Life

The Dalbar study, a landmark piece of research in the United States, uncovered one of the most damaging patterns in personal investing.

Between 1980 and 2000, the top 500 U.S.-listed companies delivered an average annual return of 12%. Yet, the average investor earned only 4% over the same period.

That staggering 8% gap wasn’t due to bad markets—it was due to bad investor behavior.

Investors who described themselves as “long-term” actually held investments for only about three years on average. When markets rose, they chased returns. When markets fell, they panicked and sold.

The same behavioral tendencies exist around the world today. Investors often let emotion—fear, greed, and overconfidence—dictate their decisions instead of following a disciplined, evidence-based process.

The CARE philosophy was developed to interrupt this destructive pattern. Its goal is to protect investors from themselves—to reduce emotional reactions, encourage patience, and promote structured, long-term decision-making.

Most investors begin the wealth destruction cycle with good intentions. When markets are strong, optimism runs high. Some even borrow to invest, hoping to amplify their gains.

But when markets decline, as they inevitably do, the emotional response shifts sharply. Negative headlines flood the media, fear takes over, and investors sell out at the lowest point.

Then, once markets recover, these same investors re-enter—buying when prices are already high.

This repeated cycle of buying high and selling low can cost investors 5–8% of their potential returns every year, a phenomenon known as the Dalbar Effect.

The CARE philosophy aims to replace this impulsive behavior with a structured approach designed to keep investors calm, focused, and consistent—especially during turbulent times.

In other words, how you behave as an investor matters just as much as what you invest in.

The CARE philosophy helps investors avoid three critical behavioral mistakes identified through decades of research:

- Panic Selling – reacting emotionally to market downturns and locking in losses.

- Forced Selling – being compelled to sell due to poor liquidity or planning.

- Lack of Diversification – concentrating too heavily on a few companies or sectors, exposing the portfolio to unnecessary risk.

For example, over a 10-year period:

- A self-directed investor earning an average return of 5% per year on a $250,000 portfolio would end up with around $407,000.

- An investor guided by a professional, maintaining discipline and structure to achieve just 2–3% higher returns, would reach roughly $525,000 to $540,000.

Stretch that to 20 years, and the difference becomes even more striking:

- The self-managed portfolio grows to about $663,000.

- The planner-supported portfolio could reach $1 million or more.

That’s a potential gap of $300,000–$400,000—created not by picking riskier investments, but simply by staying invested, diversified, and emotionally steady.

Professional guidance turns emotional reactions into measured actions—keeping investors aligned with their long-term strategy rather than short-term market noise.

Consider two investors—Alex and Jordan. Both start with the same $250,000. When markets fall, Alex, investing alone, feels anxious and sells to “protect” their money. Jordan, guided by a planner, instead receives a calm reminder that market dips are temporary. Rather than selling, Jordan sticks to the plan, even reinvesting at lower prices. Over the years, Jordan’s consistency compounds into significantly greater wealth.

That’s the quiet power of advice—it replaces fear with perspective and helps transform uncertainty into opportunity.

A skilled financial planner does this by:

- Providing perspective during volatility – offering reassurance and context when headlines trigger anxiety.

- Creating a structured investment plan – defining clear goals, timelines, and diversified strategies aligned with each client’s comfort level.

- Encouraging consistent investing habits – promoting regular contributions and dollar-cost averaging to smooth out market swings.

- Rebalancing portfolios – adjusting asset allocations as markets evolve to maintain stability and growth potential.

- Acting as a behavioral coach – guiding investors away from impulsive decisions and back toward disciplined, evidence-based action.

In essence, a good planner doesn’t just manage portfolios—they manage emotions. They help investors stay steady when markets are stormy and focused when distractions arise. Over time, that behavioral edge often becomes the most valuable investment of all.

A central pillar of the CARE philosophy is diversification—the practice of spreading investments across a wide range of companies, sectors, and asset classes.

Diversification is often visualised as the “blue line” on an index chart—a representation of hundreds or thousands of companies moving together to smooth out volatility.

Holding a diversified portfolio dramatically reduces the impact of individual company failures. For example, if one company collapses but you’re invested in 300 others, the overall effect is minimal.

Diversification doesn’t promise spectacular short-term wins—but it provides the resilience necessary for steady, long-term growth.

“Diversification means giving up the right to make a killing in exchange for never being killed.”

The CARE acronym stands for Core, Active, Reserves, and Enhanced—a structured blend of investment components that balance growth, liquidity, and risk management.

The CARE philosophy recognises that successful investing is as much about discipline and mindset as it is about strategy.

Rather than chasing “the next big thing,” it focuses on time in the market, not timing the market. Investors are encouraged to adopt a long-term perspective—understanding that markets naturally move through cycles of expansion and contraction.

A common technique within this framework is dollar-cost averaging, where investors invest consistent amounts over time. This smooths out entry prices, reduces emotional reactions, and builds long-term wealth gradually and efficiently.

The CARE approach promotes calm decision-making, structured diversification, and behavioral coaching—helping investors avoid herd mentality and instead stay focused on their own long-term objectives.

At its heart, the CARE philosophy is about helping investors live an exciting life powered by boring money—steady, disciplined, long-term growth.

It offers a framework for navigating uncertainty, making rational decisions, and building lasting wealth, even when markets are volatile. By focusing on care, structure, and behavior, this philosophy turns the chaos of short-term volatility into the steady rhythm of compounding returns.Because when you invest with discipline and care, volatility becomes an opportunity—and time becomes your greatest ally.