Protecting What Matters: A Deep Dive into Life, TPD, and Income Protection Insurance

Life rarely follows a predictable script. While you can’t control every twist and turn, you can protect yourself and your loved ones against the financial fallout of unexpected events. In Australia, three pillars of personal insurance; Term Life, Total and Permanent Disability (TPD), and Income Protection, form the foundation of a resilient financial strategy.

Life rarely follows a predictable script. While you can’t control every twist and turn, you can protect yourself and your loved ones against the financial fallout of unexpected events. In Australia, three pillars of personal insurance; Term Life, Total and Permanent Disability (TPD), and Income Protection, form the foundation of a resilient financial strategy.

These insurance types ensure that, even if illness, injury, or death disrupts your income, your financial commitments and family goals remain secure. Yet despite their importance, research consistently shows that Australia is one of the world’s most underinsured nations leaving many families financially vulnerable when the unexpected happens.

Term Life Insurance is the simplest and most essential personal insurance product. It pays a lump-sum benefit if the insured person dies or is diagnosed with a terminal illness during the policy term.

The benefit can be used to:

- Repay outstanding debts (e.g., mortgage or car loans)

- Cover education costs and living expenses for dependents

- Meet final expenses such as funeral or medical bills

Unlike older “whole of life” policies that combined savings and protection, term life insurance focuses purely on financial security and not investment growth. Policies are typically flexible, allowing you to adjust cover as your family, mortgage, or income changes over time.

Tax and Superannuation Considerations

- Outside super: Premiums are not tax-deductible, but benefits are tax-free when paid to dependents.

- Inside super: Premiums are funded through pre-tax contributions, making them more affordable. However, benefits may be taxable and subject to super release conditions.

For families, life insurance is a financial lifeline. It ensures that if the worst happens, your family’s lifestyle, education plans, and home remain intact providing emotional and financial stability at a time of loss.

While life insurance covers death, TPD insurance protects your financial future if you become permanently disabled and can no longer work. It provides a lump-sum payment to help you adapt to your new circumstances, whether that means modifying your home, covering medical costs, or replacing lost income potential.

A TPD claim is paid when the insurer determines that the insured person is unlikely ever to work again, based on the policy’s definition. This definition is crucial because it dictates when a payout occurs.

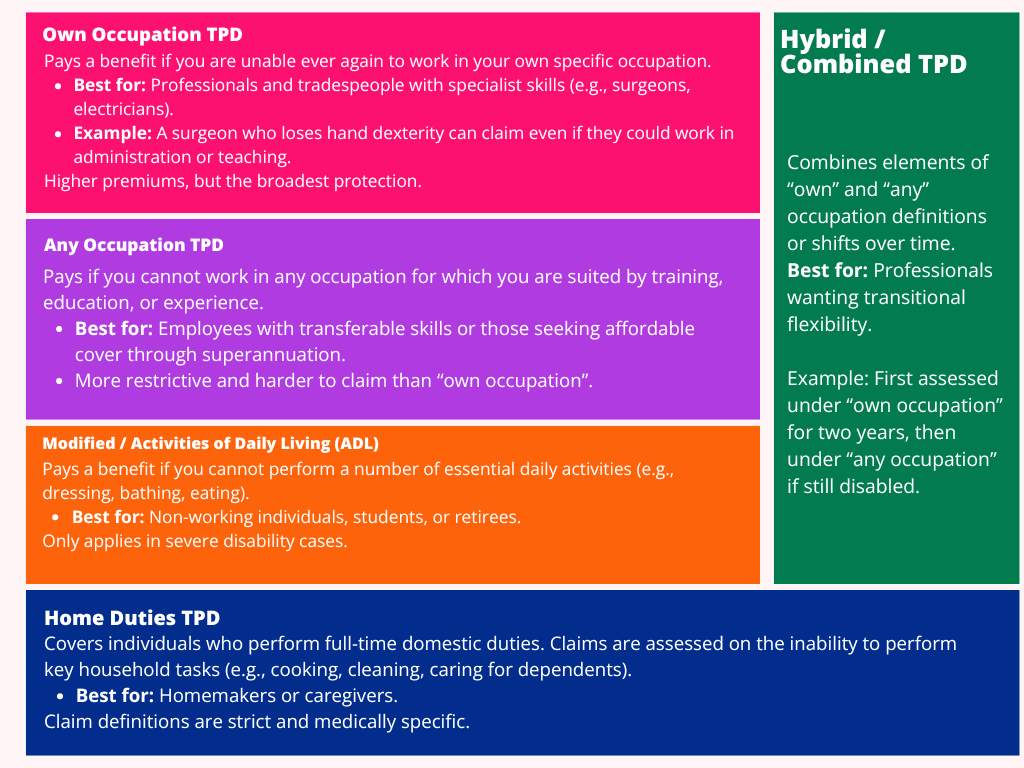

There are five main forms of TPD insurance available in Australia, each suited to different personal and occupational circumstances.

The ideal TPD cover depends on your occupation, income structure, and whether your policy sits inside or outside superannuation.

| Factor | Inside Super | Outside Super |

|---|---|---|

| Definition | Usually “Any Occupation” (meets super release rules) | Allows “Own Occupation” and other flexible definitions |

| Premiums | Paid via super contributions — cost-effective | Paid personally, higher cash outlay |

| Taxation | Benefits may be taxed if paid to non-dependents | Generally tax-free |

| Access to Funds | Requires meeting “permanent incapacity” condition | Immediate once claim is approved |

Aligning TPD With Your Financial Goals

Think of TPD as a safety net for your long-term financial obligations. When determining your cover amount and type, consider:

- Mortgage and debt — ensure your payout clears liabilities.

- Dependents — replace long-term income to maintain lifestyle.

- Business ownership — consider “own occupation” or key-person coverage.

- Existing super cover — check definitions and exclusions carefully.

Underinsurance often happens when individuals rely solely on default super cover, which may only provide $100,000–$200,000, far below the real financial need for most families.

While life and TPD insurance cover permanent loss, Income Protection addresses the temporary but financially devastating, loss of earnings due to illness or injury.

This insurance provides a monthly benefit, typically up to 70–90% of your pre-disability income, for a defined period (from two years to age 65). It ensures that even if you can’t work, your rent, mortgage, and daily living expenses continue to be met.

Key Policy Features

- Waiting period: Usually 30–90 days before payments start.

- Benefit period: How long payments last (commonly 2 years, 5 years, or to age 65).

- Indexation: Adjusts payments for inflation.

- Rehabilitation support: Covers therapy or retraining to help you return to work.

Tax Treatment

- Premiums: Tax-deductible if owned personally.

- Benefits: Taxable as income.

APRA reforms in recent years have improved sustainability by requiring policies to be based on actual income earned within 12 months prior to disability, reducing over-insurance risks.

Each policy serves a unique purpose, but when coordinated, they create a comprehensive financial safety net:

| Insurance Type | Benefit Type | Purpose |

|---|---|---|

| Term Life | Lump sum | Protects dependents after death |

| TPD | Lump sum | Covers permanent disability and loss of earning capacity |

| Income Protection | Monthly payments | Maintains income during temporary disability |

Financial advisers often layer these policies to ensure both immediate liquidity (from lump-sum payments) and ongoing income continuity. For example, income protection keeps bills paid while you recover, while TPD covers long-term financial adjustments if recovery isn’t possible.

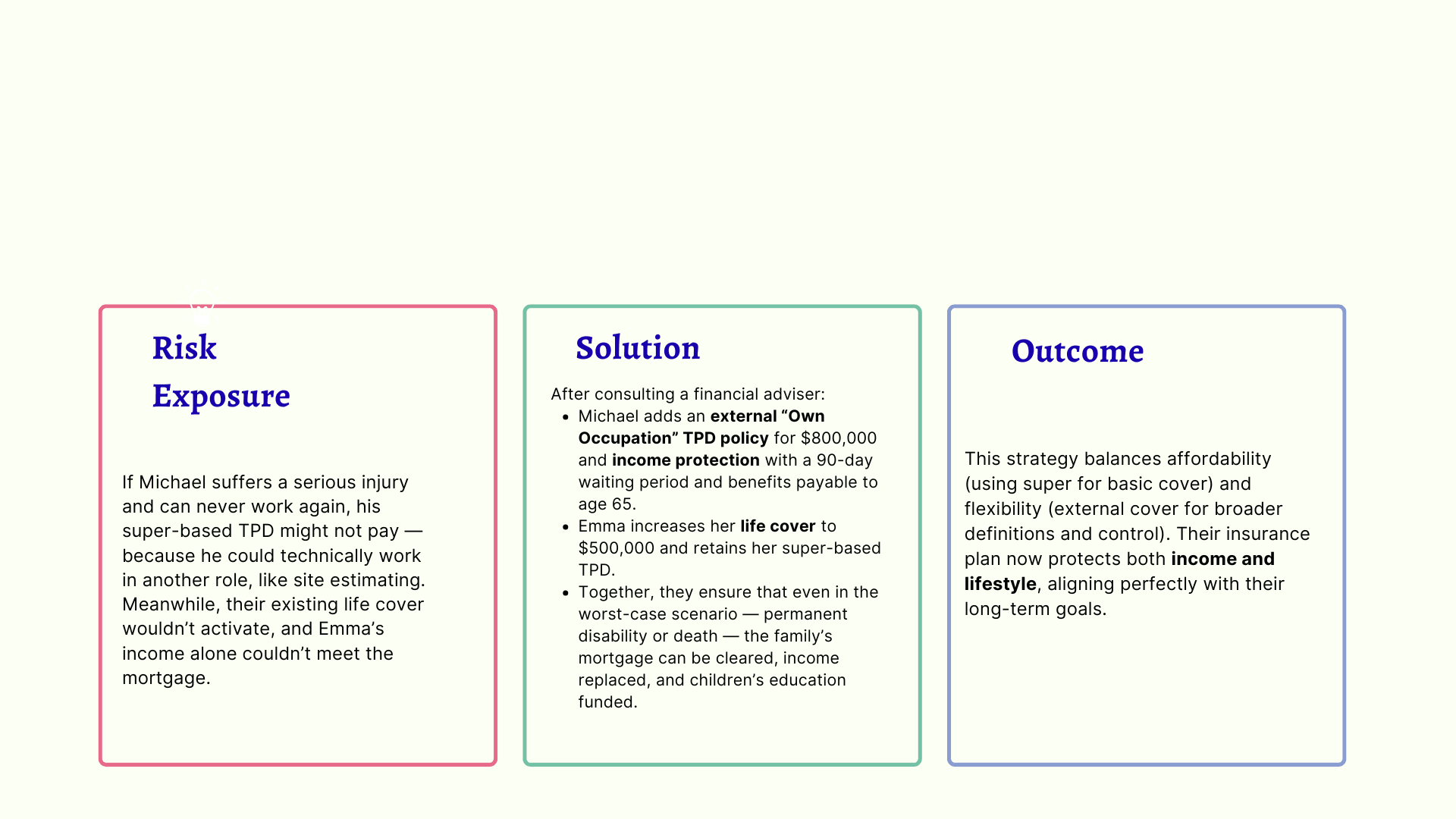

Michael and Emma – Building Comprehensive Protection

Michael (41) is a self-employed builder earning $150,000 per year. His wife Emma (39) works part-time as a teacher earning $45,000. They have a $600,000 mortgage and two children under 10.

Current Cover

- Life insurance (in super): $300,000 each

- TPD (in super): “Any Occupation” definition, $200,000 each

- No income protection

Insurance as Strategic Financial Planning

Personal insurance isn’t just about preparing for the worst, it’s about ensuring your plans stay on track no matter what happens. For Australians, integrating Term Life, TPD, and Income Protection within a single risk management framework offers:

- Financial stability in the face of life’s uncertainties

- Protection of income and wealth accumulation

- Peace of mind for you and your loved ones

Effective risk management turns uncertainty into confidence. Reviewing your coverage regularly, especially after career changes, property purchases, or family milestones ensures that your protection evolves as your life does.

Because true financial planning isn’t just about growing wealth; it’s about safeguarding it.