Should You Consider Debt Recycling in Australia?

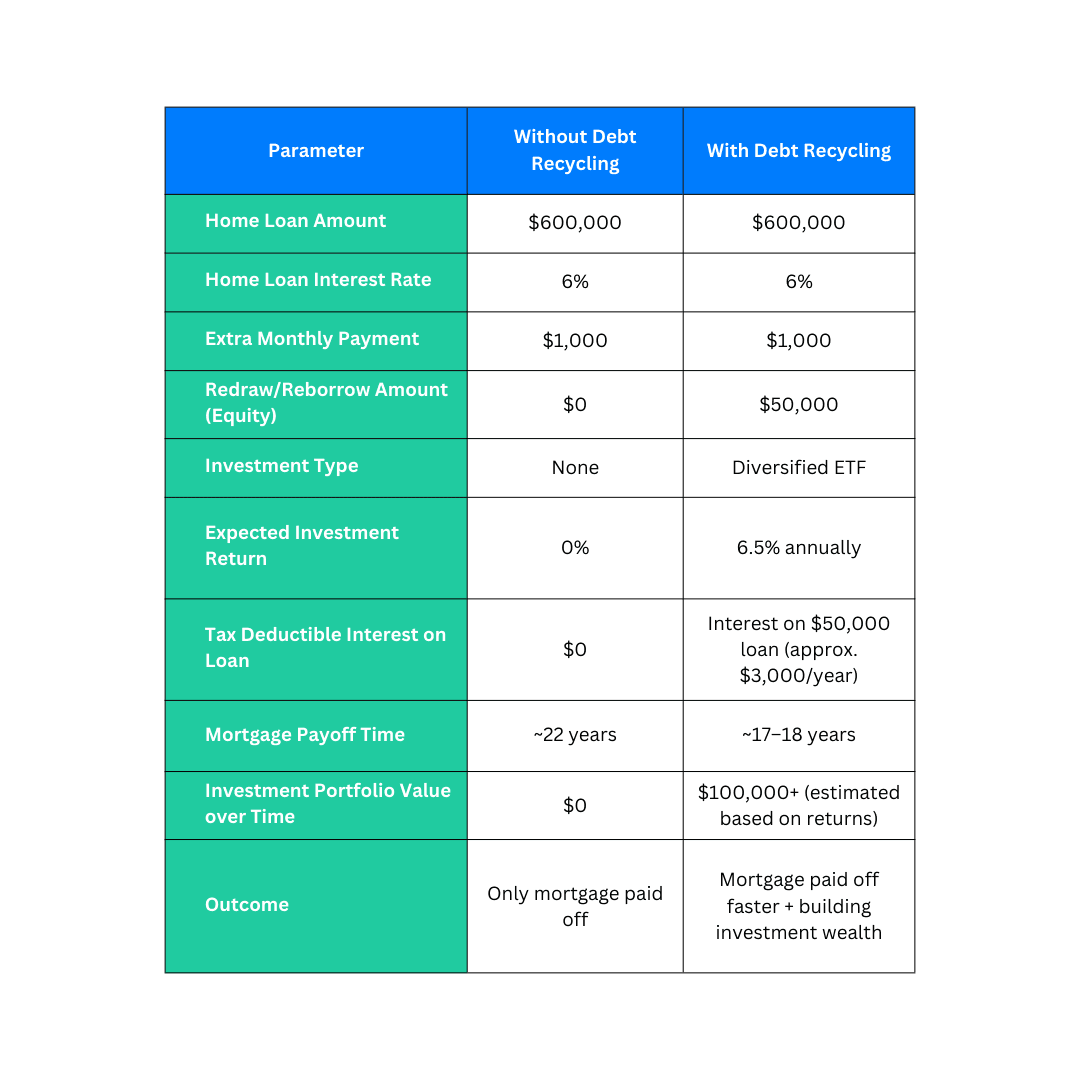

Debt recycling is a financial strategy aiming to reduce your home loan faster while simultaneously building investment wealth. By converting non-deductible home loan debt into tax-deductible investment debt, this method offers a smart approach to managing finances more efficiently.

Debt recycling is a financial strategy aiming to reduce your home loan faster while simultaneously building investment wealth. By converting non-deductible home loan debt into tax-deductible investment debt, this method offers a smart approach to managing finances more efficiently.

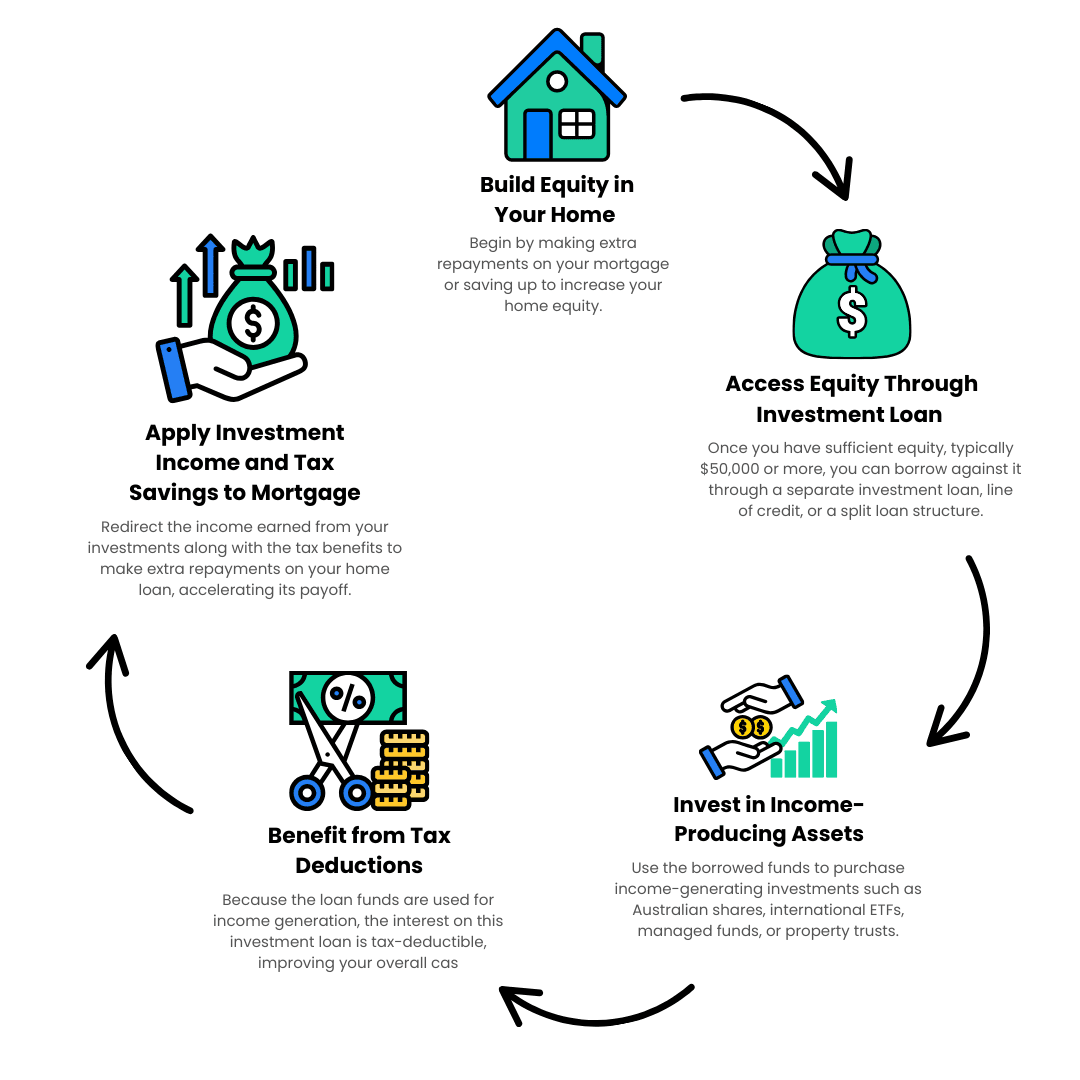

Debt recycling involves using the equity in your home to borrow for investment purposes, such as shares, managed funds, or property, which generate taxable income. The interest on this investment loan becomes tax-deductible because the borrowed money is used to earn assessable income. This approach effectively transforms your "bad debt" (home mortgage) into "good debt" (investment loan), enabling you to pay off your home loan more quickly and grow your wealth at the same time.

Repeat the Cycle

As your mortgage balance reduces and your equity grows, continue to recycle debt, progressively converting more of your non-deductible debt into deductible debt.

The Australian Taxation Office permits interest deductions only if the borrowed money is exclusively used to produce assessable income. This means:

- Loans must be clearly separated between personal and investment use.

- Proper documentation and records are essential.

- Investment assets should generate taxable income, such as dividends or rental income.

Avoid mixing personal expenses with investment borrowing to remain compliant and maximize tax benefits.

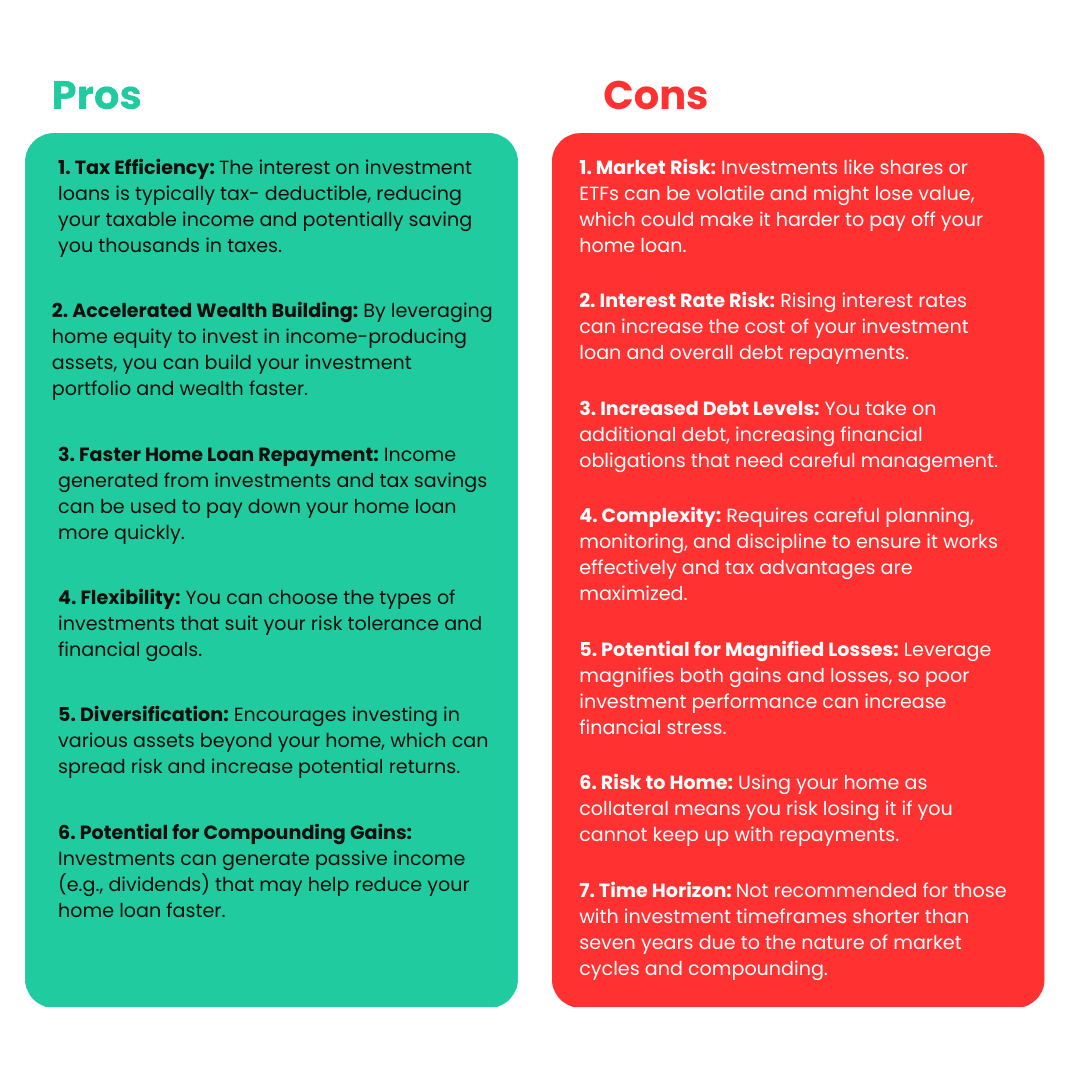

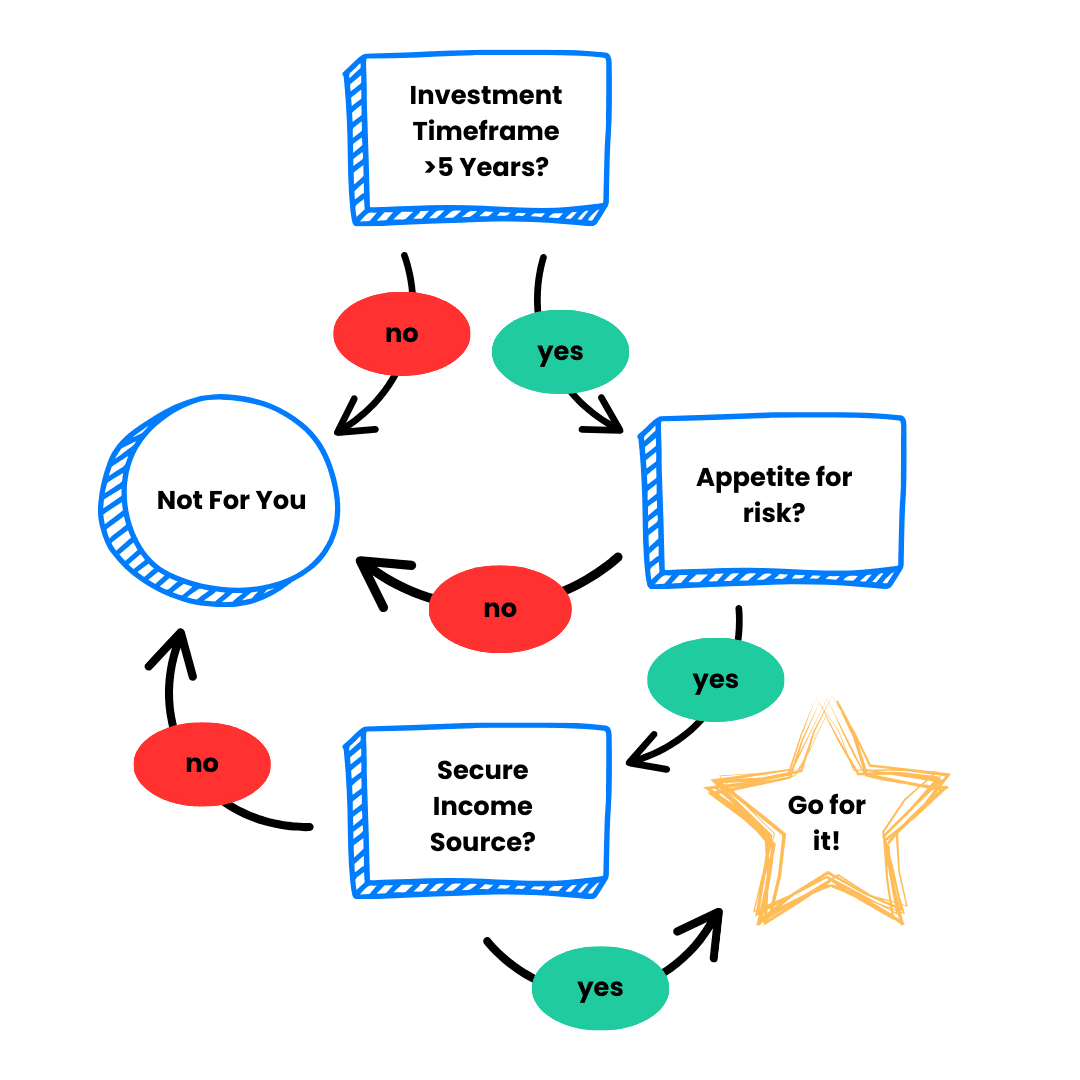

Debt Recycling is not suitable for everyone. Before considering this approach it's important to evaluate your financial situation and goals.

- Do you own your home with a current mortgage, and have you built up equity?

- Do you have a stable income that allows you to comfortably pay off your loan while maintaining surplus cash flow?

- Are you focused on long-term investment goals rather than seeking short-term results?

- Do you understand the risks involved and feel confident in your ability to manage market fluctuations?

- Do you have any protection, such as income protection insurance, to support you and your family in case of unforeseen emergencies?

If you can answer yes to these questions, debt recycling could be a suitable financial strategy for you. It requires owning a home with equity and having a reliable income to manage loan repayments while saving extra cash. A long-term investment horizon is essential because debt recycling is not designed for quick gains. Being aware of market risks and comfortable with some volatility is important to navigate the ups and downs of investing. Additionally, having protection like income insurance can provide peace of mind, ensuring financial security during unexpected events such as injury or illness.

Debt recycling involves multiple financial elements — loans, investments, taxation, and legal compliance. Professional financial advice ensures:

- The loan structure is optimal.

- Investment strategies are tailored to your goals.

- Compliance with tax laws is maintained.

- Ongoing reviews and adjustments keep your plan on track.

If debt recycling interests you as a way to build wealth or want to know whether debt recycling is suitable for you, feel free to reach out to our team for a complimentary consultation. We offer expert advice tailored to everyday families and have successfully helped many grow their wealth through strategies like debt recycling. By understanding your unique circumstances and your short-, medium-, and long-term goals, we provide personalised guidance to help you make financial decisions that truly impact your future.