Succession Planning in Australia: Is Your Australian Business Ready for the Future?

Succession planning is a vital strategy for ensuring long-term business sustainability. In Australia, where small and medium-sized enterprises (SMEs) make up more than 97% of businesses, planning for leadership transitions is not just a corporate exercise but a cornerstone of economic stability. Whether it’s a family-owned enterprise, a not-for-profit organisation, or a large corporation, succession planning helps businesses prepare for the inevitable changes in leadership and ownership while safeguarding jobs, operations, and stakeholder confidence.

Succession planning is a vital strategy for ensuring long-term business sustainability. In Australia, where small and medium-sized enterprises (SMEs) make up more than 97% of businesses, planning for leadership transitions is not just a corporate exercise but a cornerstone of economic stability. Whether it’s a family-owned enterprise, a not-for-profit organisation, or a large corporation, succession planning helps businesses prepare for the inevitable changes in leadership and ownership while safeguarding jobs, operations, and stakeholder confidence.

In this blog, we’ll explore

Succession planning is the process of identifying, developing, and preparing future leaders or owners to step into key roles when current leaders retire, resign, or are otherwise unable to continue. It ensures continuity, minimises disruptions, and allows knowledge and skills to be transferred effectively.

Without a structured plan, businesses risk operational instability, loss of expertise, and even collapse.

- An Ageing Workforce

- The Prevalence of Family Businesses

- Protecting Employees and Communities

- Regulatory and Tax Implications

Australia has an ageing population, and this is reflected in business ownership. According to the Australian Small Business and Family Enterprise Ombudsman (ASBFEO), nearly 60% of family business owners are aged over 55. Without succession plans, many businesses face uncertain futures when owners retire.

Family-run businesses account for around 70% of all Australian companies and employ more than 50% of the workforce. These businesses often face emotional challenges when handing control to the next generation. Disputes over inheritance, differing visions, or reluctance of younger family members to take over are common hurdles.

SMEs are often community anchors, providing employment and services in regional areas. Poor succession planning can lead to closures, directly impacting local economies.

Australia’s legal and tax frameworks, including capital gains tax (CGT), superannuation laws, and trust structures, add layers of complexity to succession planning. Without expert advice, transitions can become costly and time-consuming.

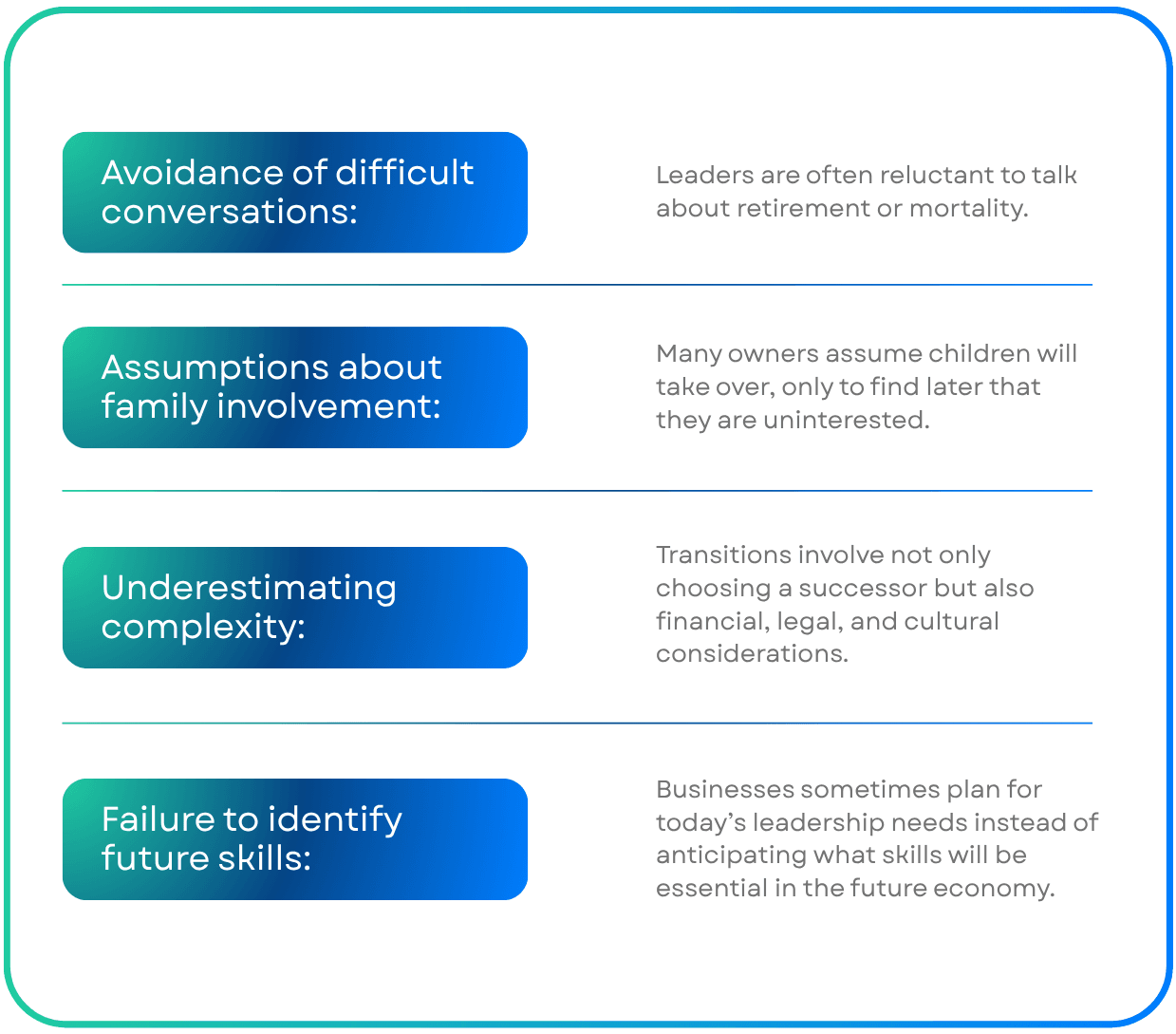

Despite its importance, many Australian organisations lack a formal succession plan. Key barriers include:

- Start Early

- Involve Key Stakeholders

- Define Selection Criteria

- Develop and Mentor Successors

- Plan for Multiple Scenarios

- Address Legal and Financial Structures

- Communicate Clearly

Succession planning should begin at least five to ten years before the expected transition. Early planning allows time to groom successors and prepare stakeholders.

Engaging family members, senior staff, board members, and external advisors ensures all perspectives are considered and reduces the risk of conflict.

Rather than defaulting to seniority or family ties, businesses should define what skills, experience, and values are essential for future leadership.

Potential successors should be given opportunities for training, mentorship, and leadership exposure. This builds confidence and ensures a smoother handover.

Unexpected events such as illness or sudden resignation can disrupt plans. Having contingency measures ensures resilience.

Seek professional advice to structure ownership transfers in a tax-effective and legally sound manner.

Transparent communication reduces uncertainty among employees and builds trust.

In addition to traditional approaches, Australian businesses and families are increasingly looking to SAPEP (Succession, Asset Protection, Estate Planning) as a more comprehensive strategy.

For business owners—particularly those in family enterprises—SAPEP offers peace of mind by safeguarding assets, reducing exposure to legal or financial risks, and ensuring that both business continuity and personal wealth are protected for future generations. As adoption grows, it is set to become a vital tool in how Australian organisations approach long-term planning.

The Succession Planning Process

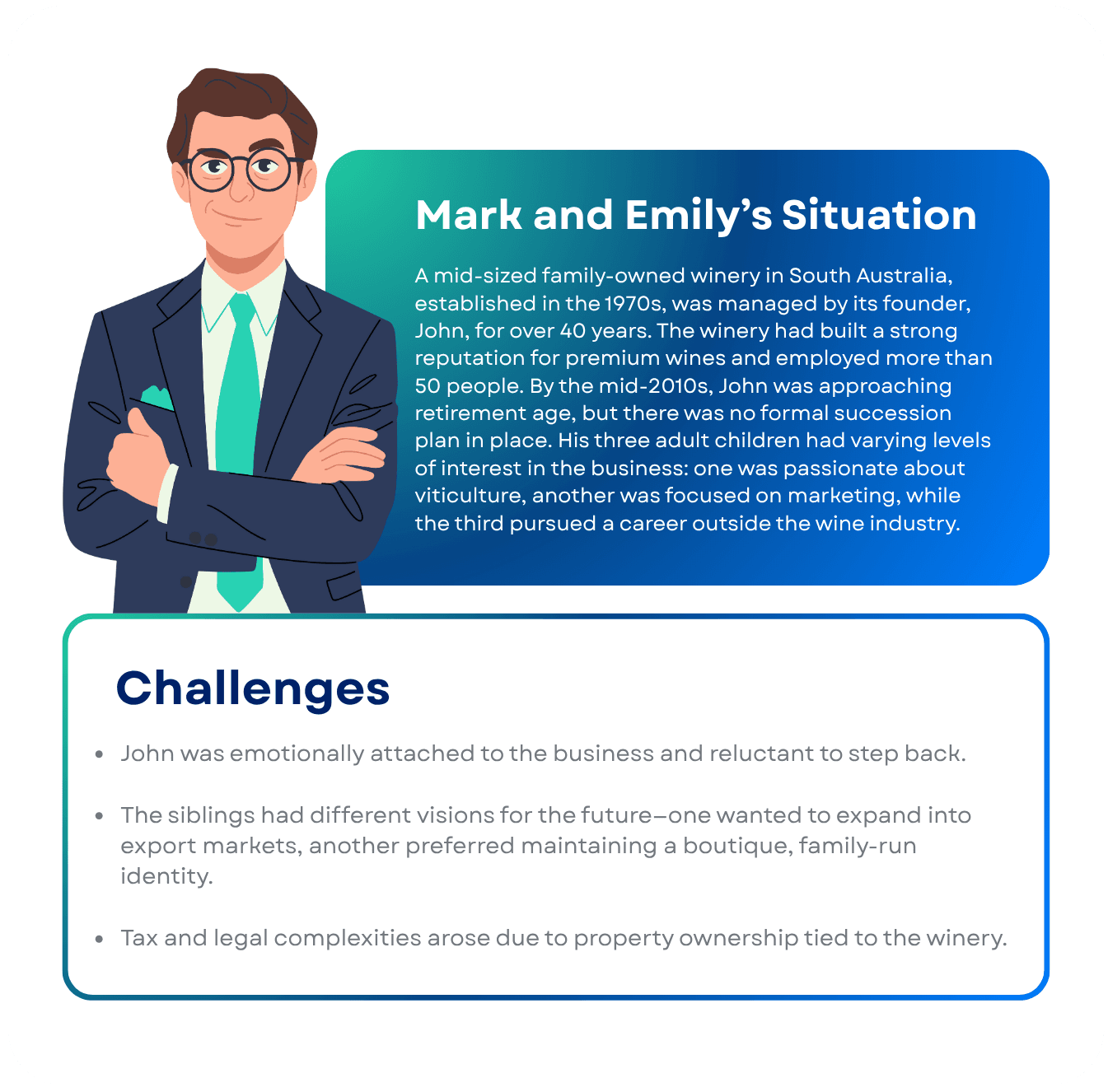

Recognising the risks of not planning, the family engaged external advisors, including a succession planning consultant and a tax accountant. Together, they implemented the following steps:

- Clarified Goals and Values

- Defined Roles

- Structured Ownership Transfer

- Incorporating SAPEP Principles

- Built Leadership Capacity

Through facilitated family meetings, the members discussed their personal aspirations and aligned on the shared values they wanted the winery to uphold.

The child passionate about viticulture was groomed for the role of managing director, while the sibling skilled in marketing took charge of branding and customer engagement. The third sibling chose not to be actively involved but retained a shareholding interest.

Advisors developed a tax-efficient structure that gradually transferred ownership shares to the next generation while ensuring John’s retirement income security.

To safeguard the winery’s assets and streamline intergenerational wealth transfer, the family explored elements of the SAPEP framework (Succession, Asset Protection, Estate Planning). This included restructuring property ownership to protect against potential creditor claims, reviewing their SMSF strategy to fund John’s retirement, and integrating estate planning to ensure a fair division of assets among all siblings—including the one not directly involved in management.

The new leaders underwent leadership training and worked alongside John for three years before the formal transition.

Outcome

The transition was completed smoothly, with minimal disruption to employees and customers. The winery has since expanded its footprint in international markets while retaining its family-oriented brand identity. By applying SAPEP principles, the family not only ensured business continuity but also secured long-term asset protection and created a retirement strategy that supported John without straining the business. Importantly, clear communication and external mediation prevented family disputes that might otherwise have jeopardised the company.

- An Ageing Workforce :Employees and stakeholders remain confident during transitions.

- Retention of knowledge:Skills and expertise are passed down systematically.

- Stronger family and business relationships:Open communication reduces conflicts.

- Financial security:Proper structuring minimises tax burdens and protects wealth.

- Future growth:Fresh leadership often brings new ideas while maintaining legacy values.

Succession planning is not just about preparing for leadership exits; it’s about securing the long-term viability of businesses that form the backbone of Australia’s economy. From family farms and wineries to major corporations, every organisation benefits from having a clear, structured plan in place. By doing so, organisations not only protect their legacy but also build a foundation for future generations to thrive.