Want Your Business to Thrive, Not Just Survive? Here’s Why Budgeting and Cash Flow Matter

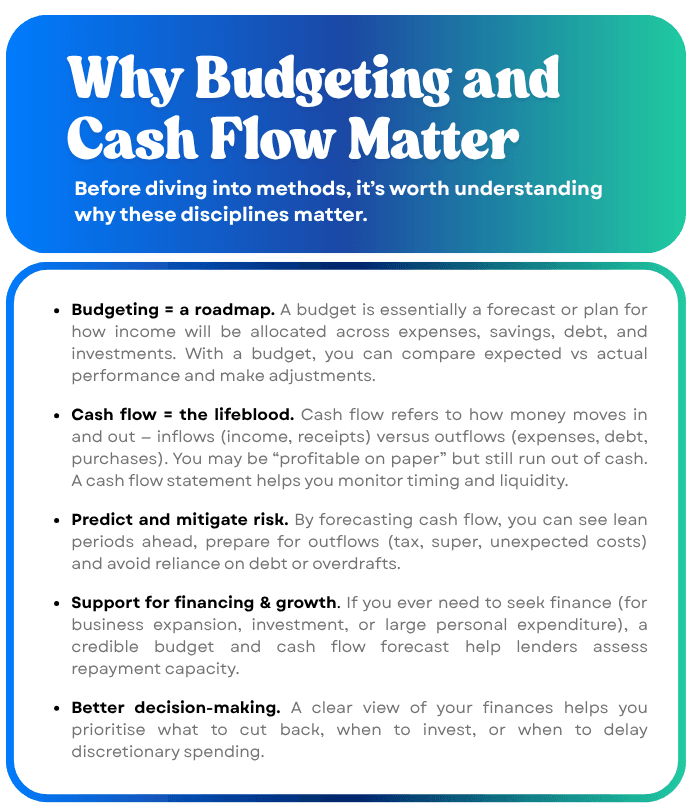

Effective budgeting and cash flow management are foundational for financial stability — whether for individuals, households, small businesses or larger enterprises. In Australia, with its unique tax rules, superannuation system, variable costs (utilities, fuel, housing) and regulatory environment, mastering these financial skills is especially valuable.

Effective budgeting and cash flow management are foundational for financial stability — whether for individuals, households, small businesses or larger enterprises. In Australia, with its unique tax rules, superannuation system, variable costs (utilities, fuel, housing) and regulatory environment, mastering these financial skills is especially valuable.

This blog will cover

In short: budgets help you plan, cash flow helps you stay alive financially in real time.

Common Challenges for Australians

Australians face some particular constraints and cost pressures that complicate budgeting and cash flow:

1. ariable income / seasonal work

Many Australians are employed in sectors with peaks and troughs (e.g. tourism, agriculture, construction, hospitality). Irregular income makes budgeting harder.

2. Cost pressure on essentials

Housing (rent or mortgage), utilities, energy, insurance, health, childcare — these costs can escalate, squeezing discretionary buffers.

3. Tax, super and compliance

Australians must account for income tax, GST (if running a business), and superannuation contributions (for employers). Missing these obligations can hurt cash flow. The ATO emphasises that a cash flow budget or projection is best practice for staying on top of such obligations.

4. Debt & credit availability

Access to credit cards, personal loans or redraws can lead to “spending ahead” of one’s means, undermining cash discipline.

5. Unexpected shocks

Health events, car repairs, natural disasters or economic shifts (inflation, interest rises) can disrupt budgets.

Because of these, traditional budget models (rigid allocations) sometimes fail — they don’t handle real life’s messiness.

Principles of Good Budgeting & Cash Flow Management

Here are some guiding principles to make your budgeting truly useful.

1. Be realistic and flexible

A budget must be grounded in real income and likely cost ranges. Allow buffers and room for adjustment (e.g. a 5–10% contingency margin for variable costs).

2. Match the cash timing

You need to align when money comes in with when money goes out. For example, if your income is fortnightly but bills are monthly, you might build a separate smoothing account to buffer.

3. Prioritise “must-haves” over “wants”

In a cash squeeze, focus first on essentials: housing, utilities, food, insurance, debt service. Discretionary spending should only come once basics are secure.

4. Automate where possible

Automatic transfers into savings or paying bills reduces decision fatigue and helps enforce discipline.

5. Track and review regularly

A budget is not “set and forget.” Review your actuals monthly (or fortnightly), compare to the plan, identify variances and refine your next iteration.

6. Scenario test & forecast

Run “what-if” scenarios (e.g. what if electricity doubles, or you lose 20% of income). Stress testing helps you prepare contingency plans.

Here’s a step-by-step approach you can follow:

Step 1: Determine your time frame & granularity

Decide whether your budget & forecast will be monthly, fortnightly or weekly. For many Australians, a monthly budget is a good starting point, since many bills and salaries are on a monthly cycle.

Step 2: Estimate income (cash inflows)

List all expected cash receipts: employment salary (after tax), side gigs, rental income, investment dividends, government benefits, etc. For businesses, include receivables, grants, sales, etc.

Step 3: List outflows (cash expenses)

Break expenses into categories — fixed, variable, discretionary:

- Fixed: rent/mortgage, insurance, subscriptions, loan repayments

- Variable: utilities, fuel, groceries, maintenance, phone/internet

- Discretionary: dining out, entertainment, vacations, impulse purchases Don’t forget seasonal or annual costs (e.g. registration, insurances, gifts).

Step 4: Build a cash flow statement / forecast

Using your opening cash balance, project the net cash flow each period (inflows minus outflows). Then derive the closing cash balance (which becomes the next opening balance).

Mark when cash might go negative and see where buffers or adjustments are needed.

Step 5: Identify cash shortfalls or surplus periods

Use your forecast to identify when you might run low — say, in a “quiet” month. Also spot surplus periods where you might accelerate savings or investment.

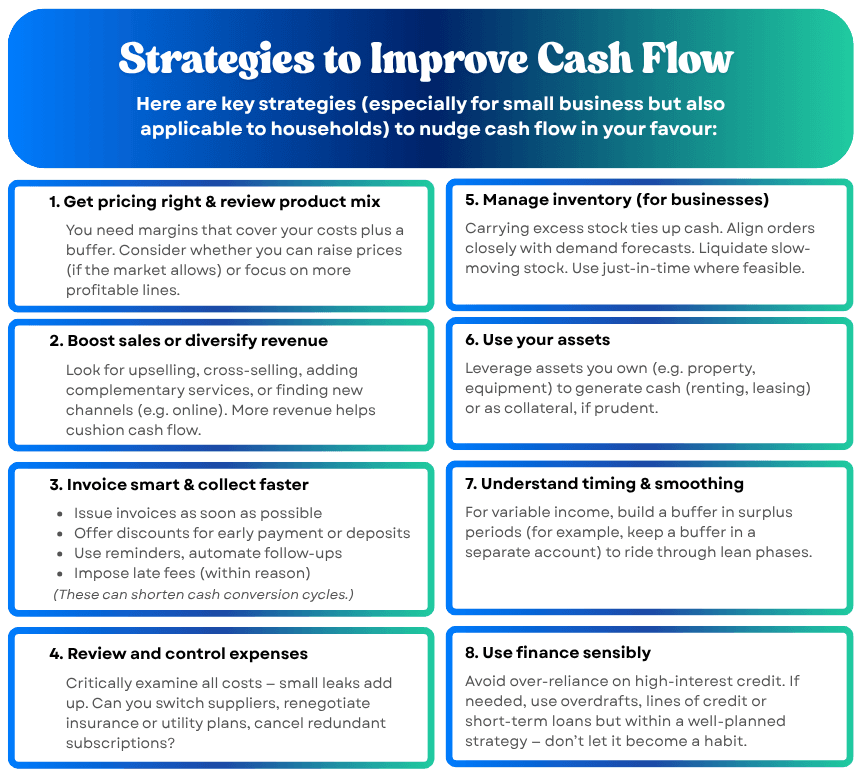

Step 6: Implement strategies to manage timing

If you foresee a cash squeeze, you can use techniques like:

- Negotiating payment terms (ask suppliers for extended terms or split payments)

- Adjusting invoice timing (issue invoices earlier, request deposits)

- Accelerating or delaying some discretionary spending

- Saving in a “buffer account” during surplus months to smooth lean ones

Step 7: Monitor and review

At the end of each period, you compare actuals vs forecast:

- Where did you over- or under-spend?

- Why did revenue deviate?

- What adjustments should you make next period?

Make this part of your regular financial routine.

How Financial Advisers Can Help

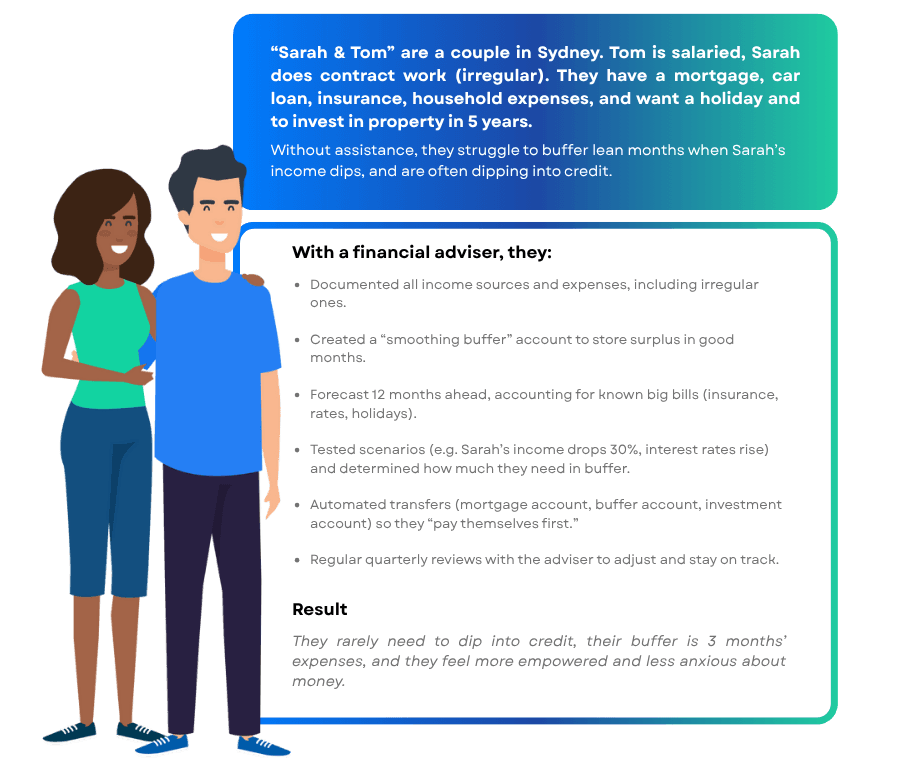

You might wonder: “Can’t I just DIY this?” Sure — many people do — but a qualified financial adviser (or planner) can add substantial value, especially when financial complexity or goals increase. Here’s how:

1. Professional diagnosis and system setup

A financial adviser can do a health check: assess your current cash flow and budgeting practices, identify blind spots, and help you design a system (spreadsheets, software, accounts) tailored to your personality, goals and constraints. Advisers help match the budgeting approach to your psychology (e.g. strict vs flexible, envelope/bucket styles vs rules)

2. Scenario modelling & forecasting

Advisers often use robust software to simulate multiple cash flow scenarios: best case, worst case, “shock” stress tests. This is especially useful when you plan for major life events (buying property, having children, changing jobs, investing, retirement).

3. Goal alignment & prioritisation

Many people set budgets by accident rather than intention. An adviser helps you map your budget to your deeper goals — debt reduction, travel, retirement, philanthropy — and guide the allocation (i.e. trade-offs) properly.

4. Behavioural accountability & coaching

One of the biggest obstacles is staying consistent. Advisers act as accountability partners: regular reviews, nudges, and course corrections. They help keep emotional impulses in check (“splurge spending,” fear of constraint).

5. Tax, super, regulatory integration

In Australia, budgeting can’t ignore tax and superannuation. Advisers weave in those aspects — e.g. how much to withhold, timing of tax payments, super contributions, how to manage cash flow when business and personal finances overlap.

They also help you avoid cash flow surprises from compliance (e.g. tax liabilities, super obligations). For businesses, advisers liaise with accountants or tax professionals to coordinate cash timing.

6. Investment / debt optimization

Once your baseline budget is stable, an adviser helps optimise what to do with surplus funds (investments, paying down debt, retirement planning) and how to manage leverage wisely — aligning debt repayments, refinancing strategies and investment returns.

7. Long-term monitoring & adjustment

Your life evolves (new job, move, family changes, market shocks). Advisers review your financial plan periodically, update forecasts, and help you pivot as necessary.

8. Credibility for finance applications

If you need to apply for a loan, investment, mortgage, or business credit, a solid, adviser-backed budget and cash flow forecast builds credibility with lenders and gives you confidence in your proposals.

Case Study Example

Common Pitfalls & How to Avoid Them

| Pitfall | Why It Happens | Mitigation |

|---|---|---|

| Over-optimistic revenue assumptions | Wishful thinking vs reality | Use conservative estimates; apply a “confidence factor” (e.g. use 80% of expected revenue) |

| Ignoring timing differences | Assuming revenue and costs happen same month | Always map actual cash timing (e.g. payment delays, supplier terms) |

| Neglecting “one-off” obligations | Taxes, equipment purchases, licencing | Build these into forecast explicitly |

| Letting forecasts run stale | No review or update | Schedule monthly or quarterly refreshes |

| No buffer or contingency | Thinking “we’ll be fine” | Prioritize building reserves early |

| Over-rigid budgets | Getting discouraged when variances occur | Build flexibility into your plan; use variance analysis to adjust |

Partner with a Financial Advisor to Transform Your Budgeting and Cash Flow Outcomes

Budgeting and cash flow management are not glamorous, but they are among the most powerful tools in your financial toolbox. For Australians facing variable costs, regulatory obligations and financial risks, disciplined planning and regular review can make the difference between anxiety and confidence.

While many people can start a budget or simple forecast, the complexity of real life (business operations, tax, investments, life changes) means that partnering with a financial adviser can exponentially enhance your outcomes. They bring objective perspective, scenario modelling, accountability, and integration across all your financial dimensions.